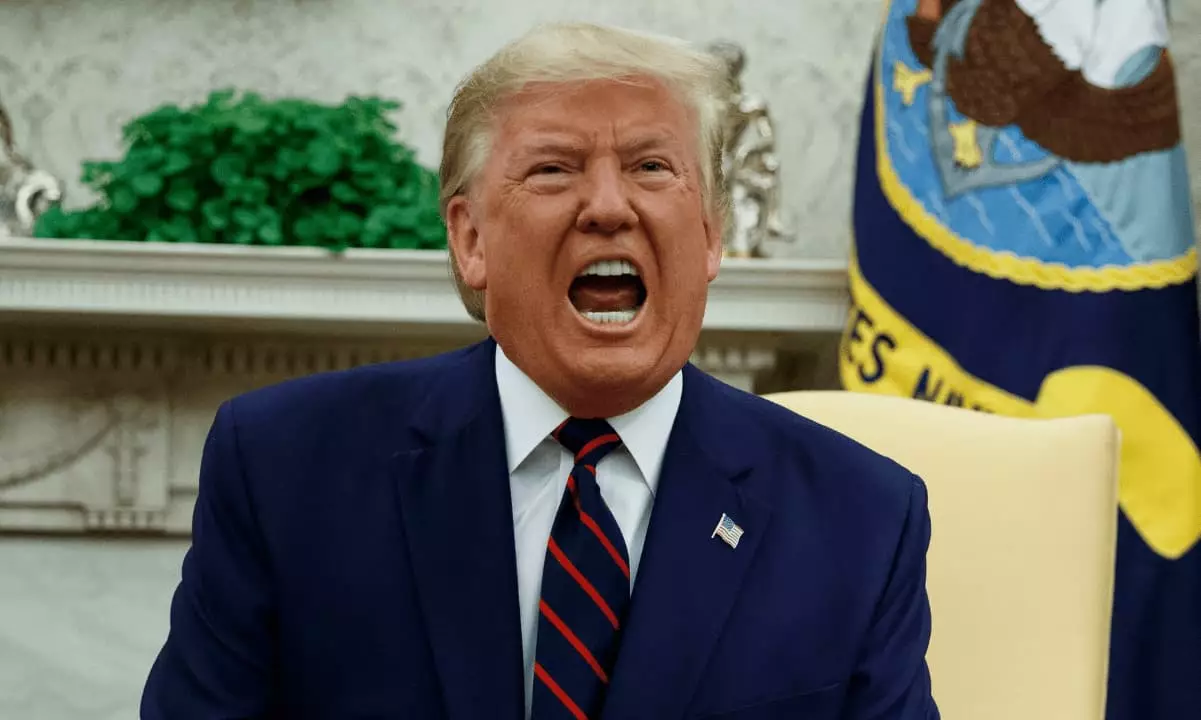

In the turbulent waters of American politics, new challenges continually arise, and one of the more disconcerting issues at the moment centers around the intertwining of cryptocurrency and electoral fundraising. The current inquiry initiated by House Democrats into President Donald Trump’s financial ventures within the crypto sphere is much more than a mere partisan skirmish; it reveals the potential for corruption, foreign influence, and the alarming mismanagement of political power. This scrutiny exemplifies the urgent need for transparency in political finance, particularly in realms as nebulous and often chaotic as cryptocurrency.

The investigation specifically targets a network of fundraising platforms, notably WinRed, various political action committees, and even Elon Musk’s America PAC, all woven together in a tapestry that suggests opportunistic exploitation of the crypto boom. The Democrats’ allegations hit home with precision, pointing out what may be not just unethical behavior but outright illegal activities masked as fundraising ventures.

Conflict of Interest: An Inevitable Outcome?

The entanglement of Trump’s political ambitions with the crypto cache `World Liberty Financial` (WLF) raises profound ethical dilemmas. Notably, the WLF’s fundraising approaches and its failed WLFI token sale have sparked criticism and suspicion, particularly following a hefty $75 million purchase from Justin Sun—an individual already jogging with regulators regarding SEC investigations. This has morphed into an intricate narrative that involves the apparent manipulation of political power for financial gain, reminiscent of the age-old adage that money corrupts.

The clustering of financial operations under the Trump umbrella—including meme coins associated with him and Melania—reveals a troubling pattern. If he controls a staggering 80% of the supply of the TRUMP coin, one must question whether this is a rational investment or simply a vehicle for profiting off his political undertakings. Such intricacies emphasize the blurred lines between personal wealth management and state responsibilities, raising the question: Is integrity in governance truly a viable expectation?

Foreign Influence: A National Security Dilemma

One element of this muddled situation cannot be overlooked—national security. The House Democrats highlighted the anonymity of coin buyers and pointed fingers at foreign investors, some allegedly connected to China, who have made significant profits while American investors have suffered losses exceeding $2 billion. Such dynamics not only invite allegations of insider trading but also raise broader concerns about foreign influence infiltrating U.S. policy and decision-making processes.

The pursuit of profit within political frameworks should always be treated with suspicion, and in this instance, the stakes are exceedingly high. If foreign nationals become significant players in promoting the interests of Trump-associated financial projects, what does this mean for the sovereignty and integrity of American politics? The scenario is unnervingly reminiscent of past instances where foreign entities’ financial maneuvering has shaped domestic policy, leading only to exacerbated concerns over who truly holds the reins of power.

The Ethics of Mixing Business and Politics

A critical aspect of this inquiry revolves around the ethical implications of allowing political figures, particularly a sitting president, to engage in venue-laden deals that might represent a direct conflict of interest. The announcement of a stablecoin called USD1 to facilitate investments in Binance—a platform with its own troubled legal history—strikes an unsettling chord. The proximity of these actions to current political maneuvers signals a glaring disregard for ethical boundaries that uphold the integrity of political leadership.

The recent threats from lawmakers, who have made it abundantly clear that they will pursue regulatory measures against political figures profiting from cryptocurrencies, underline the anxieties surrounding the potency of money in the political landscape. Proposals, such as Rep. Ritchie Torres’s bill and Senator Elizabeth Warren’s calls for ethics investigations, suggest a growing bipartisan consensus on the need for tougher regulations governing political fundraising in the crypto context.

In the concert of ambiguous financial practices and political affiliations, the call for greater oversight is not just timely—it is essential. As America’s socio-political landscape undergoes continued transformation, the allure of cryptocurrencies should not eclipse the fundamental principles of accountability and ethics that underpin the integrity of its political system. The current investigation signifies but a chapter in an evolving discussion on how best to navigate the murky waters of financial influence within modern-day politics. It is crucial that this inquiry leads to substantive action if the forces of corruption are to be kept at bay.

Leave a Reply