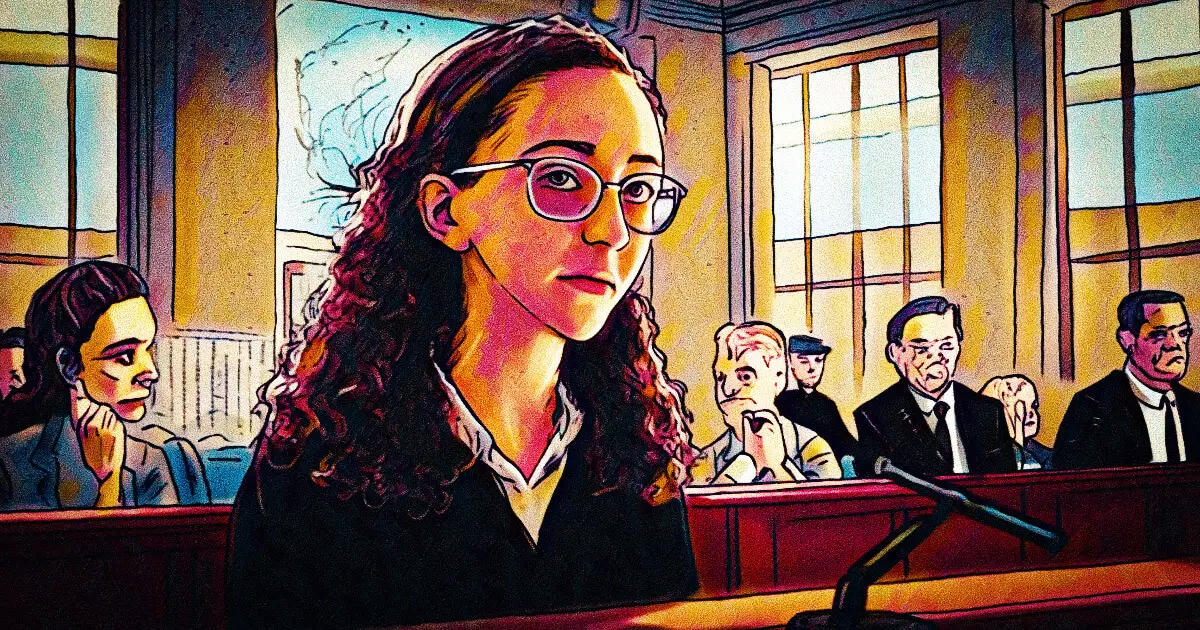

The cryptocurrency market has been shaken to its core, primarily stemming from the meteoric rise and catastrophic fall of FTX, a major crypto exchange. Caroline Ellison, the former CEO of Alameda Research, finds herself at the center of this drama following her recent sentencing to two years in prison. Additionally, she has been ordered to forfeit a staggering $11 billion as a consequence of her involvement in the nefarious activities that led to FTX’s collapse. This situation serves not only as a punishment for individual transgressions but also raises critical questions about the ethical responsibilities that come with financial roles in such a volatile industry.

Despite a compelling plea from her legal team, who requested that she receive no prison time based on her critical testimony against Sam Bankman-Fried (SBF), the court’s ruling suggests a clear message. Ellison’s attorneys highlighted her cooperation with federal investigators, arguing that her insights were invaluable in piecing together the financial mismanagement at FTX and Alameda, ultimately aiding in asset recovery. They noted her return from the Bahamas and her willingness to assist authorities, which they deemed deserving of a lenient sentence.

However, the judge’s decision illustrates a stark contrast between regulatory leniency towards cooperation and the need for accountability within the financial sector. The court weighed Ellison’s cooperation against the broad implications of her actions, which contributed to the downfall of a once-great institution within the cryptocurrency realm.

Ellison’s case is emblematic of a larger pattern emerging within the cryptocurrency sector, where high-profile figures are increasingly facing severe legal consequences for their actions. Classifying her sentencing alongside others in similar positions reveals an urgent exploration of ethical practices in the industry. Just a few months prior, Ryan Salame, another executive linked to FTX, received a seven-and-a-half-year prison sentence, while fellow executives Nishad Singh and Gary Wang await their fates. This mounting legal drama highlights the precarious balance in the crypto industry between ambitious financial innovation and the ethical implications of unregulated environments.

The sentencing of Caroline Ellison sends a strong message to industry players: that cooperation with authorities, while beneficial, does not exempt individuals from facing consequences for their actions. As the cryptocurrency market evolves and regulatory frameworks become increasingly scrutinized, it is vital for stakeholders to adhere to ethical standards. FTX’s collapse has ushered in a new era of introspection within the sector, with calls for better compliance, accountability, and consumer protection gaining momentum.

While Ellison’s cooperation may have altered the trajectory of her sentencing, it cannot absolve her of a pivotal role in a scandal that devastated countless investors. For the cryptocurrency industry to regain the public’s trust, it must undergo significant introspection and reform, ensuring that financial innovation does not come at the expense of ethical governance. The ramifications of Ellison’s case should resonate across the broader landscape, serving as a cautionary tale to future executives on the vital importance of integrity in financial practices.

Leave a Reply