The legal confrontation between the Securities and Exchange Commission (SEC) and Ripple Labs has taken another dramatic turn, following the SEC’s decision to appeal a pivotal federal court ruling. This move, announced on October 2nd, 2024, centers around the regulatory body’s lawsuit against Ripple, which dates back to December 2020. The ongoing case has major implications not only for Ripple but for the entire cryptocurrency industry, as it wrestles with legal definitions and regulatory frameworks.

The SEC’s legal action against Ripple Labs accused the company of conducting an unregistered securities offering worth approximately $1.3 billion through its XRP token sales. The SEC argued that XRP should be considered a security, thereby subjecting it to the same regulatory requirements as traditional securities. This position has led to a protracted and contentious legal battle, highlighting the ongoing struggle within the crypto space to define and regulate digital assets.

For the SEC, the stakes have always been high. The agency has been determined to assert its authority over the burgeoning cryptocurrency market, contending that a strong regulatory framework is necessary to protect investors and ensure fair practices. However, Ripple’s counterarguments have resonated with many within the industry, as it has consistently maintained that XRP is not a security, but rather a digital currency. Ripple’s legal team has seized on the idea that the sales of XRP do not meet the criteria set forth by existing securities laws.

In August 2024, the U.S. District Judge Analisa Torres issued a mixed ruling that brought both disappointment and relief to the parties involved. The decision found that while Ripple’s direct sales of XRP to institutional investors constituted unregistered securities transactions—leading to a substantial penalty of $125 million—its programmatic sales through cryptocurrency exchanges did not violate securities laws.

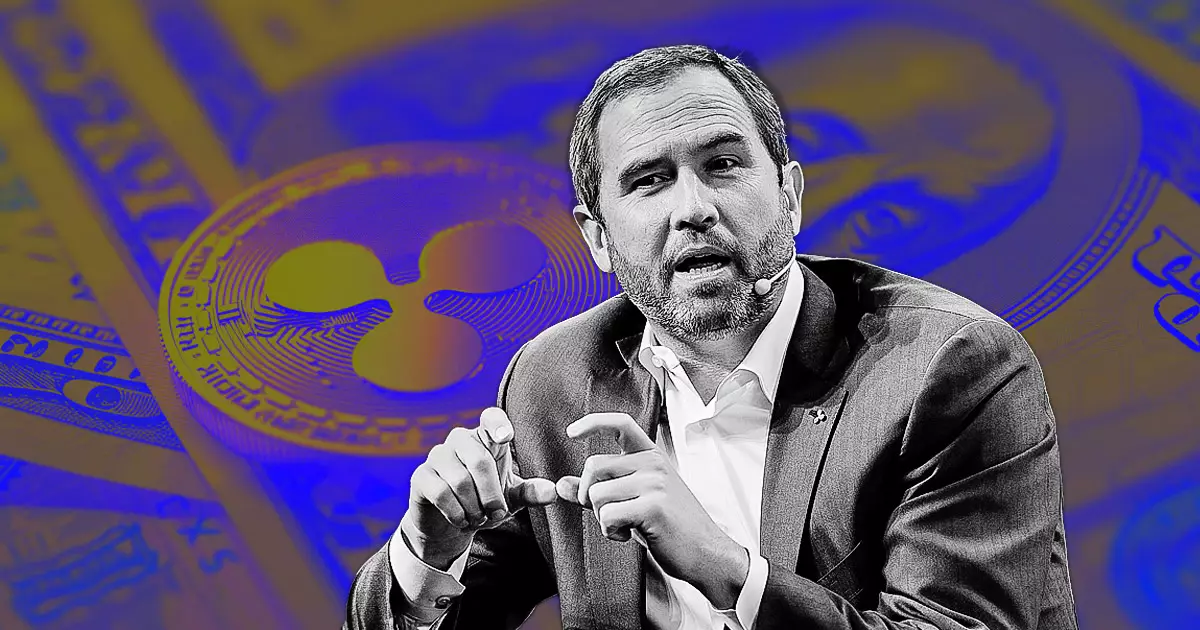

This ruling was celebrated by Ripple as a significant win for the broader cryptocurrency ecosystem. CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty publicly expressed their optimism, framing the decision as a validation of the crypto sector’s legal standing. However, the SEC was quick to announce its intention to appeal, asserting that the court’s conclusions were inconsistent with established legal precedent.

The SEC’s appeal has reignited tensions between the regulatory body and Ripple Labs. Garlinghouse expressed his frustration over the SEC’s continuation of legal action, arguing that it amounts to a waste of taxpayer resources on a battle that Ripple has already won in essential areas. He indicated that the ongoing legal proceedings are detrimental to the crypto industry, emphasizing the importance of regulatory clarity for developers and investors alike.

In light of the SEC’s decision to appeal, Ripple remains determined to fight back, with Garlinghouse asserting that XRP’s classification as a non-security should remain intact despite the SEC’s ongoing claims. Alderoty echoed this sentiment, highlighting the lack of victims or financial losses as a core element of the case. He criticized the SEC for what he termed litigation “warfare” against the entire industry, positioning Ripple’s potential future actions as part of an ongoing strategy to combat regulatory overreach.

The news of the SEC’s appeal has instigated further volatility in the XRP market, with the cryptocurrency’s value dropping nearly 9% following the announcement. As of October 3, 2024, XRP traded at approximately $0.54, reflecting the uncertainty permeating both the asset and the broader market. The total cryptocurrency market remains a significant player in the financial landscape, with Bitcoin dominance hovering above 56%, indicating its continued status as a market leader.

The SEC’s actions have broader implications, not only for Ripple but for all cryptocurrencies vying for legitimacy in an increasingly regulated environment. The outcome of this case could set critical precedents, shaping how regulatory bodies perceive and categorize digital assets for years to come. The continuing appeal process may ultimately lead to a greater understanding of regulatory expectations, but it also raises concerns regarding the SEC’s approach and the impact of prolonged litigation on innovation in the cryptocurrency industry.

As the SEC’s appeal unfolds, both Ripple Labs and the cryptocurrency community remain on edge. The outcome could redefine regulatory frameworks and clarify the legal status of various digital assets. For Ripple, the stakes are high—not just for their own operations, but for the future of cryptocurrency itself. As discussions continue about the appropriate balance between regulation and innovation, all eyes will be on this pivotal legal battle and the precedents it may set for years to come.

Leave a Reply