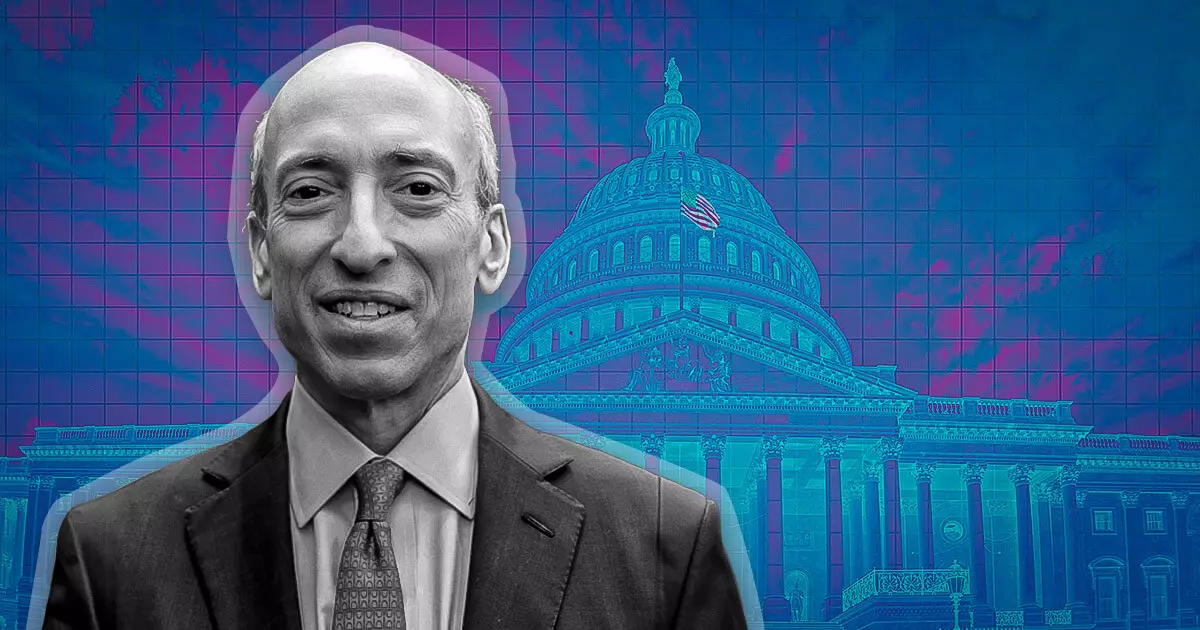

The world of finance is riddled with tension, particularly in an era defined by rapid technological advancement and the rise of cryptocurrencies. One poignant flashpoint is the ongoing discourse surrounding Gary Gensler, the chair of the U.S. Securities and Exchange Commission (SEC). Tyler Winklevoss, co-founder of the Gemini crypto exchange and renowned Olympic rower, has positioned himself as a vocal critic against Gensler’s approach to regulating the burgeoning industry of digital currencies. His recent comments offer a scathing critique of not only Gensler’s intentions but also the overall approach the SEC has adopted towards cryptocurrency.

Winklevoss’s assertions depict Gensler’s decisions as premeditated and driven by a personal, political agenda rather than genuine regulatory oversight. This characterization raises questions about the accountability of regulatory bodies—should the SEC’s leadership be scrutinized for potentially acting in self-interest rather than in the public good? Winklevoss asserts that Gensler’s actions led to “irreparable damage” within the cryptocurrency space, impacting jobs, investments, and ultimately American innovation. Such claims invite a deeper examination into how regulators often walk a fine line between stewardship and stifling progress.

The derogatory labels attached to Gensler—referred to as “evil” by Winklevoss—suggest a moral failing rather than mere incompetence. This perspective reflects a common grievance among advocates for cryptocurrency, who often perceive regulation as an oppressive tool wielded against modern economic opportunities instead of a necessary framework designed to protect consumers.

Winklevoss’s condemnation culminates in a sweeping demand for accountability: he insists that Gensler should not occupy any influential position in the future. This urgency presents a critical outlook not only on Gensler but also on the broader implications of having regulatory leaders who may not align with the values or interests of the industries they oversee. It suggests a need for a systemic overhaul within the SEC to ensure that future chairs prioritize innovation while still providing necessary oversight, rather than merely seeking to uphold the status quo.

Moreover, Winklevoss posits that financial institutions or educational establishments that engage Gensler post-SEC tenure should be boycotted. This call for collective resistance raises significant ethical considerations regarding loyalty, impact, and the potential for reforming regulatory behavior through economic and social pressures.

The backdrop of political maneuvering underscores Winklevoss’s criticisms. Not only has he highlighted Gensler’s controversial governance style but also connected the broader political landscape impacting financial regulatory practices. The fact that states have banded together to sue the SEC for perceived overreach signals a growing frustration among various stakeholders who view Gensler’s actions as excessive and detrimental to both the industry and consumers.

Additionally, the political aspirations of figures like Donald Trump, who has pledged to dismiss Gensler should he regain the presidency, further complicate the relationship between regulatory oversight and political ideology. Such dynamics illustrate how regulatory practices can become politicized, potentially eroding trust in institutions designed to uphold fairness and transparency.

As the cryptocurrency industry grapples with increasing scrutiny and regulatory challenges, Winklevoss’s critiques prompt important dialogues about innovation, freedom, and accountability. The complex interplay between regulation and technological advancements necessitates a balanced approach that fosters growth while maintaining necessary safeguards against exploitation.

Looking ahead, it is crucial for the SEC, under Gensler or any successor, to genuinely engage with industry stakeholders and rethink outdated regulatory frameworks that could impede future advancements. Constructive dialogues between regulators and innovators could lead to a more adaptable and effective regulatory environment, ultimately benefiting the economy and society at large.

The complexities of regulating a rapidly evolving industry like cryptocurrency warrant a nuanced appreciation of power and responsibility. It is through open dialogue, accountability, and an awareness of the political implications of regulatory actions that a sustainable future for digital assets can be forged.

Leave a Reply