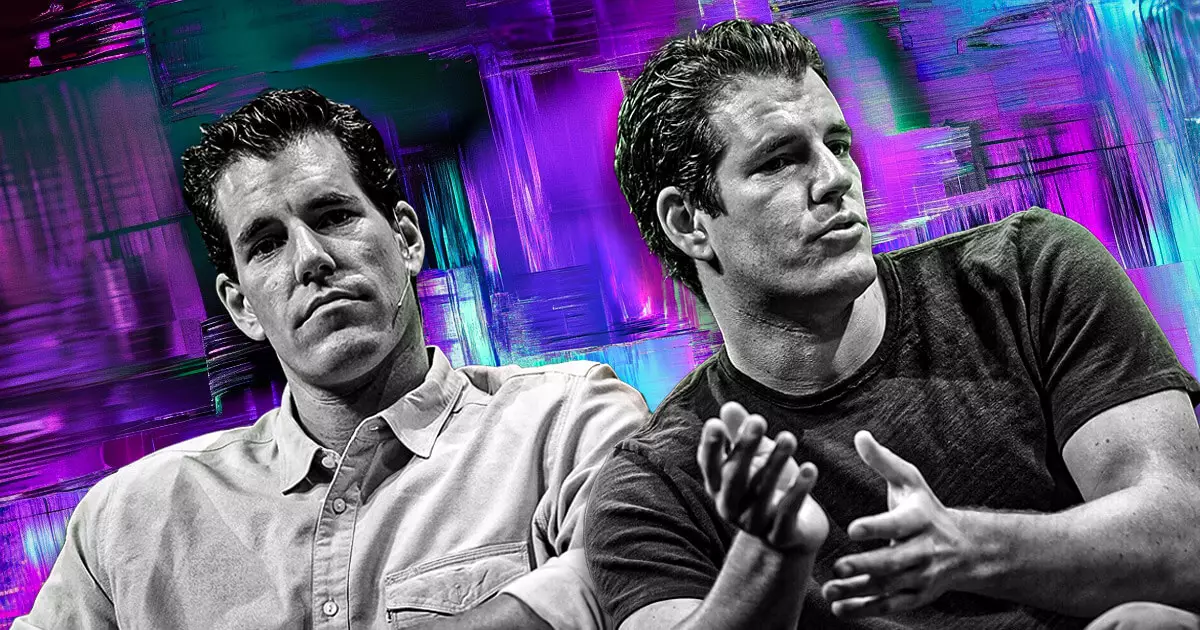

In a bold and telling maneuver, Gemini has taken the critical step of filing a draft registration statement with the US Securities and Exchange Commission (SEC) for an initial public offering (IPO) of Class A common stock. This strategic move, made by the Winklevoss twins, Cameron and Tyler, signals not just the ambition embedded within Gemini but reflects the increasing normalization of cryptocurrency exchanges within the bureaucratic frameworks of traditional finance. This ambitious filing on June 6 not only positions Gemini at the forefront of the crypto revolution but also exemplifies a significant moment in the financial landscape—a moment where the lines between digital and traditional finance are blurred beyond recognition.

The SEC’s Role and Market Dynamics

For Gemini, the road to IPO is not merely about securing funds; it’s about navigating the labyrinth of regulatory scrutiny that the SEC embodies. The requirement for the SEC to declare the registration effective emphasizes the intricate relationship between innovation and regulation—a dance that many in the crypto space are learning to master. Commentators in the financial world, like Bloomberg’s James Seyffart, have opined that a pro-digital asset stance from the current administration could catalyze a wave of IPOs among various crypto markets, indicating a progressive shift that could either validate or destabilize the existing financial structure.

The current momentum for Gemini cannot be understated. The recent performance of other digital asset companies, most notably Circle, which made headlines with an explosive market debut, provides an optimistic backdrop. Circle’s shares skyrocketed from an initial price of $31 to over $119 within days, showcasing a ravenous appetite for crypto-related investments among the public. This signals an underlying confidence in the profitability of cryptocurrency platforms, despite the skeptics pointing to volatility as a significant risk. The enthusiasm for Circle has been infectious, potentially setting the stage for Gemini’s entry into the public arena.

The Influence of Private Crypto Firms and Market Sentiment

The broader implications of Gemini’s potential IPO cannot be ignored. Analysts like Jason Yanowitz and Simon Dedic of Moonrock Capital have noted a pivotal shift in how investment banks approach the burgeoning crypto market. Their encouragement—“it’s go time”—reflects an evolving sentiment that may lead to a frenzy of activity among private crypto firms seeking similar recognition and capital through public markets. Whether or not these firms can sustain investor interest remains a pivotal question. The major fluctuations witnessed post-Circle’s IPO are indicative of the volatile environment that crypto still resides within.

Interestingly, rumors of Kraken’s potential IPO, possibly orchestrated by heavyweights like Goldman Sachs, reveal a growing trend among established digital asset firms directly correlating with favorable equity market conditions. The chess game unfolding suggests a proactive attitude among leaders in the crypto space—executives are acting not merely on impulses, but rather strategic foresight into how regulations and market sentiment are evolving.

Challenging Traditional Financial Norms

While the prospect of Gemini going public is thrilling for many investors, it invites a broader commentary on the implications of such transitions. Can traditional frameworks adapt to accommodate an industry once relegated to the fringes? The IPOs of crypto companies challenge the status quo, forcing legacy institutions to reconsider their stances on innovation and transformation. For Gemini, joining the ranks of publicly traded companies would signify not just a leap in financial success but a declaration that the future of finance is digital—swift, dynamic, and unlike anything the world has seen before.

In this rapidly evolving landscape, the IPO ambitions of Gemini stand as a bellwether for what lies ahead.

Leave a Reply