In a striking display of market influence, Galaxy Digital has recently effectuated a colossal transfer of Bitcoin, moving over 17,000 BTC—valued at around $1.7 billion—within a single 24-hour window. This substantial liquidation raises eyebrows not just within the crypto community but also among traditional financial observers who understand the weight such institutional moves carry. The timing and magnitude suggest a strategic pivot, possibly signaling less confidence in the bullish trajectory of Bitcoin or an attempt to reposition assets ahead of potential downturns. Such large-scale liquidations, particularly originating from entities with a reputable institutional stature, inject a sense of fragility into the market, especially when coupled with declining prices and thin liquidity pools.

What’s truly alarming is the pattern underlying these movements. The transfers largely originated from dormant legacy wallets, inactive for over a decade, but suddenly awakened this month to shuttle over 80,000 BTC. The final batch of over 40,000 BTC was sent just recently, often in increments that hint at deliberate selling rather than simple custody management. This kind of behavior underscores a potentially bearish sentiment—a strategic distribution rather than accumulation, designed to expedite exiting positions before the market-driven decline deepens.

Implications for Bitcoin’s Price and Market Sentiment

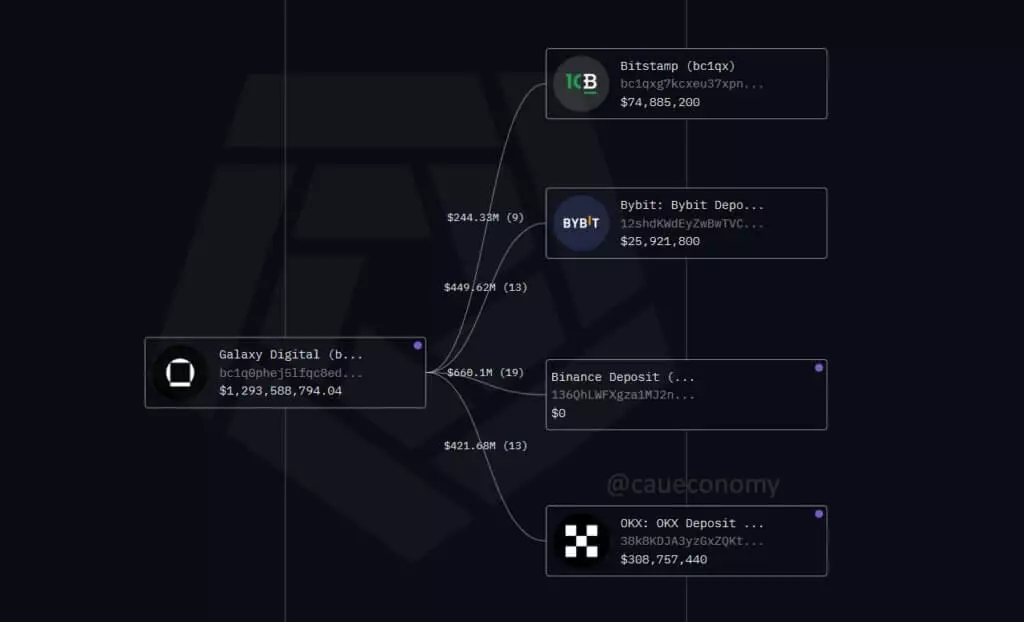

The immediate consequence of this mass movement has been a notable dip in Bitcoin’s price, which has fallen approximately 2.5% overnight, currently trading around $115,600. These price movements, coupled with daily trading volumes surpassing $94 billion, reflect heightened volatility and a possible shift in trader sentiment. The on-chain data reviewed by analysts reveals that much of the Bitcoin transferred from Galaxy’s wallets has been heading towards exchange hot wallets. This pattern, commonly associated with distribution, hints that Galaxy Digital might be orchestrating a broader sell-off rather than merely redistributing assets for safekeeping.

Such behavior, once associated predominantly with retail traders or erratic whales, now appears to permeate the institutional layer. This prompts questions about ongoing confidence in Bitcoin’s resilience or whether a coordinated exit—perhaps in response to regulatory concerns, macroeconomic shifts, or internal risk management—is underway. Furthermore, the size and timing of these transfers are not coincidental; they could foreshadow a more extended downtrend, especially as liquidity thins and sellers outpace buyers.

Broader Market Risks and Future Outlook

The situation at Galaxy Digital is more than isolated corporate maneuvering; it reflects underlying vulnerabilities within the Bitcoin ecosystem. Institutions hold large positions and possess the capacity to sway markets significantly—either stabilizing or destabilizing according to their actions. The net outflow of 40,000 BTC over recent days signals a potential shift from accumulation to distribution among major holders. This is particularly dangerous in a market where large sell orders absorbed by thin order books can accelerate price collapses.

Despite some optimistic narratives about long-term growth, the reality remains that such tactical liquidations expose systemic weaknesses. They highlight the delicate balance between institutional confidence and market stability. As traders and investors watch these developments, skepticism grows, making it clear that Bitcoin’s short-term outlook is clouded by the strategic moves of key players. If more institutions choose to follow Galaxy’s example, the market could face a sustained period of downward pressure, questioning the assumption that Bitcoin remains a resilient store of value amidst macroeconomic uncertainty.

Leave a Reply