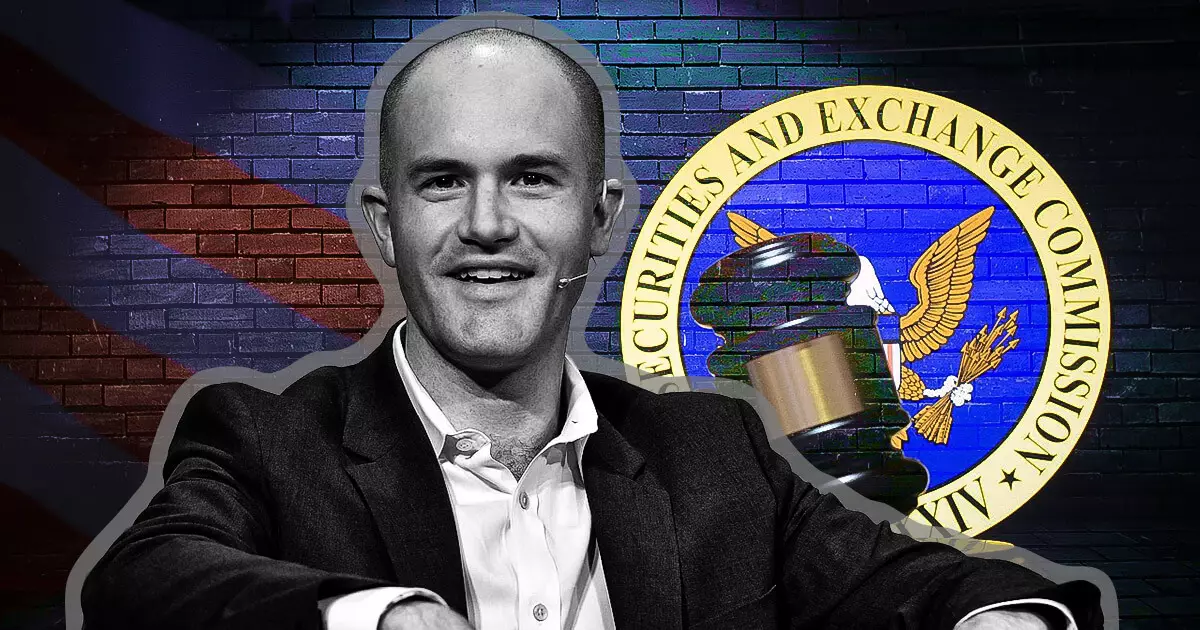

In December 2023, the cryptocurrency exchange Coinbase made headlines when its CEO, Brian Armstrong, declared that the company would terminate its relationships with law firms that employ former regulatory officials involved in what he deems as “unlawful” actions against the crypto sector. This statement reflects not only the frustrations within the crypto community but also demonstrates the heightened tensions between regulatory bodies and cryptocurrency enterprises. Armstrong’s comments came in light of former SEC Enforcement Director Gurbir S. Grewal’s recent appointment at the law firm Milbank. The move has sparked an intense debate about the ethics of former regulators joining private sectors that they once supervised.

Armstrong’s criticism is particularly pointed. He alleges that senior partners at prominent law firms lack a fundamental understanding of the unique challenges the crypto landscape faces. By targeting Grewal, Armstrong conveys a broader sentiment: that former regulators, who contributed to stifling innovation through stringent enforcement, should not be rewarded with lucrative positions in private practice. This assertion raises ethical questions about the revolving door between public and private sectors, where regulatory officials leverage their experience in ways that may disadvantage the industries they once regulated.

Armstrong’s description of Grewal’s tenure as an “ethics violation” shines a light on contentious issues regarding regulatory accountability. It suggests that Armstrong believes regulators bear responsibility for their actions, particularly when these actions have demonstrably adverse effects on emerging markets such as cryptocurrency. His remarks emphasize the need for transparency and ethical integrity in law, especially as it pertains to sectors like crypto, which are striving for legitimacy in a skeptical environment.

Armstrong’s message isn’t solely an indictment of individuals; it is also a clarion call for clearer regulatory frameworks. By stating that the prior SEC administration under Gary Gensler “unlawfully targeted” the crypto industry, he underscores a growing demand within the sector for clear and coherent guidance. The lack of a coherent framework leaves industry players navigating a confusing legal landscape, often resulting in unwarranted enforcement actions that could stagnate growth and innovation.

While Armstrong offers a platform for accountability, he also acknowledges the importance of not “permanently canceling” individuals. His position invites a critical discourse around personal accountability versus systemic issues within regulatory bodies. Armstrong’s push for law firms to rethink their hiring practices suggests that the crypto sector values collaboration with legal representatives who can navigate the complex regulatory environment without compromising the industry’s integrity.

The stance taken by Coinbase represents a pivotal moment in the ongoing struggle between cryptocurrency firms and their regulatory counterparts. Armstrong’s bold statements encourage the crypto industry to reconsider its relationships with legal advisors, emphasizing the need for supportive regulation rather than adversarial tactics. As the industry evolves, it becomes increasingly crucial for these conversations to continue—paving the way for a more equitable relationship between regulators and innovative enterprises in the crypto space. Armstrong’s dedication to fostering healthy partnerships highlights both the challenges and opportunities that lie ahead for the cryptocurrency sector as it continues to grow and mature in a complex regulatory environment.

Leave a Reply