In a move that has raised eyebrows across both the tech and finance landscapes, cryptocurrency exchange Gemini has opted to halt the hiring of graduates and interns from the Massachusetts Institute of Technology (MIT). This decision stems from the university’s recent association with Gary Gensler, the former Chair of the U.S. Securities and Exchange Commission (SEC). This article delves into the motivations behind Gemini’s actions, the reactions from key industry figures, and the broader implications for the crypto sector and academic affiliations.

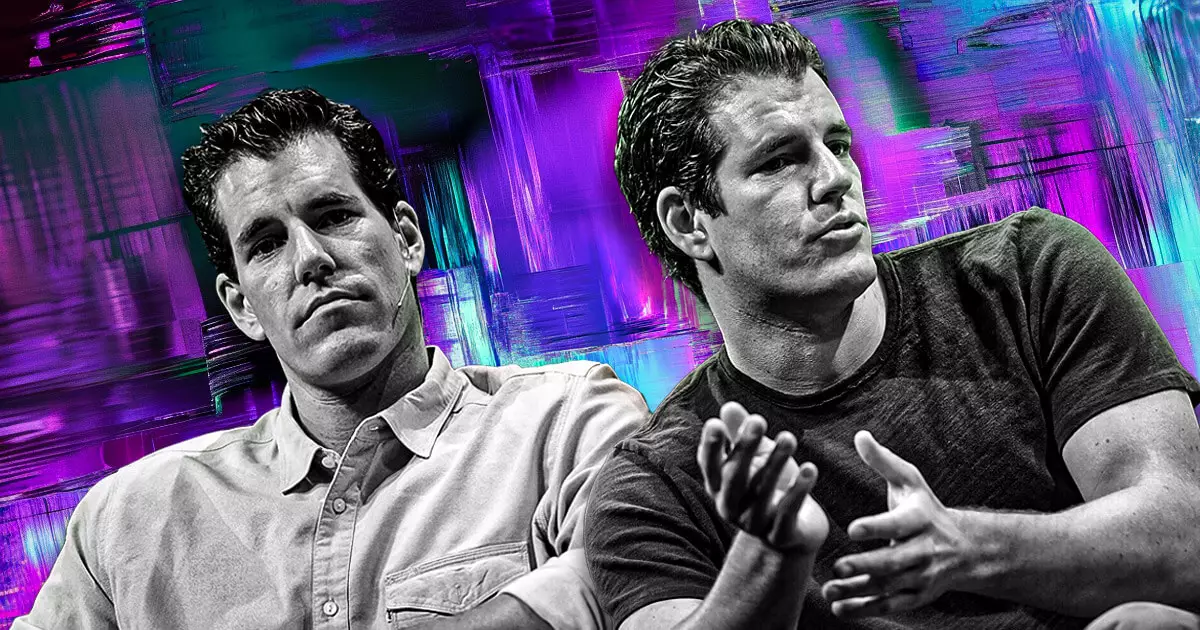

On January 29, Tyler Winklevoss, one of Gemini’s co-founders, took to social media to voice his opposition to MIT’s decision to rehire Gensler as a Professor of Practice in its Sloan School of Management. Winklevoss announced a firm stance: “As long as MIT has any association with Gary Gensler, Gemini will not hire any graduates from this school. Not even interns for our summer intern program.” This bold statement signals not only a fractious relationship between the crypto exchange and regulatory figures but also a potential re-evaluation of the hiring criteria within the rapidly evolving industry.

Cameron Winklevoss, Tyler’s brother and co-founder of Gemini, echoed this sentiment. He denounced Gensler’s return to MIT as a lapse in judgment, calling the former SEC chair “the world’s leading expert on public policy failures.” This suggests that the Winklevoss twins view Gensler’s policies as detrimental to the very innovation that their company embodies and promotes.

Gensler’s reappointment to MIT has elicited mixed reactions, particularly within the crypto community, where his name is often associated with stringent regulatory measures that many blame for stifling innovation. During his tenure at the SEC, he was known for enforcing regulations that critics argue created hurdles for crypto companies. Therefore, his academia affiliation has sparked protest from those who feel that his methods may extend beyond government and into academia, potentially shaping future generations’ views on cryptocurrency and blockchain technology.

Matt Huang, co-founder of Paradigm, further fueled the discourse by encouraging MIT-affiliated crypto professionals to express their discontent with the direction the university has taken. His comments indicate growing unrest in the industry regarding academic and regulatory relationships and how they manifest in hiring practices.

Caitlin Long, CEO of Custodia Bank, brought up a critical inquiry into whether Gemini’s actions signify a larger industry-wide shift, suggesting that more firms may begin to distance themselves from educational institutions that welcome figures like Gensler. Long’s statement challenges other industry leaders to consider their connections and hiring practices more carefully, initiating a critical conversation about how past policy-makers influence future generations.

In light of these developments, the crypto industry might find itself at a crossroads. Companies are faced with the challenge of fostering innovation while navigating a landscape riddled with regulatory encounters and external perceptions. As such, Gemini’s decision reflects a growing discontent that could influence future hiring practices and the nature of partnerships between the crypto world and academic institutions.

As this situation continues to unfold, the ramifications of Gemini’s stance may extend beyond the immediate implications of hiring freezes. This represents a pivotal moment for the relationship between academia and industries operating on the cutting edge of technology and innovation. With potential boycotts looming and rising tensions, stakeholders in the cryptocurrency sector may need to scrutinize their affiliations and the impact of these relationships on their future growth and adaptability in a continuously shifting regulatory landscape.

Leave a Reply