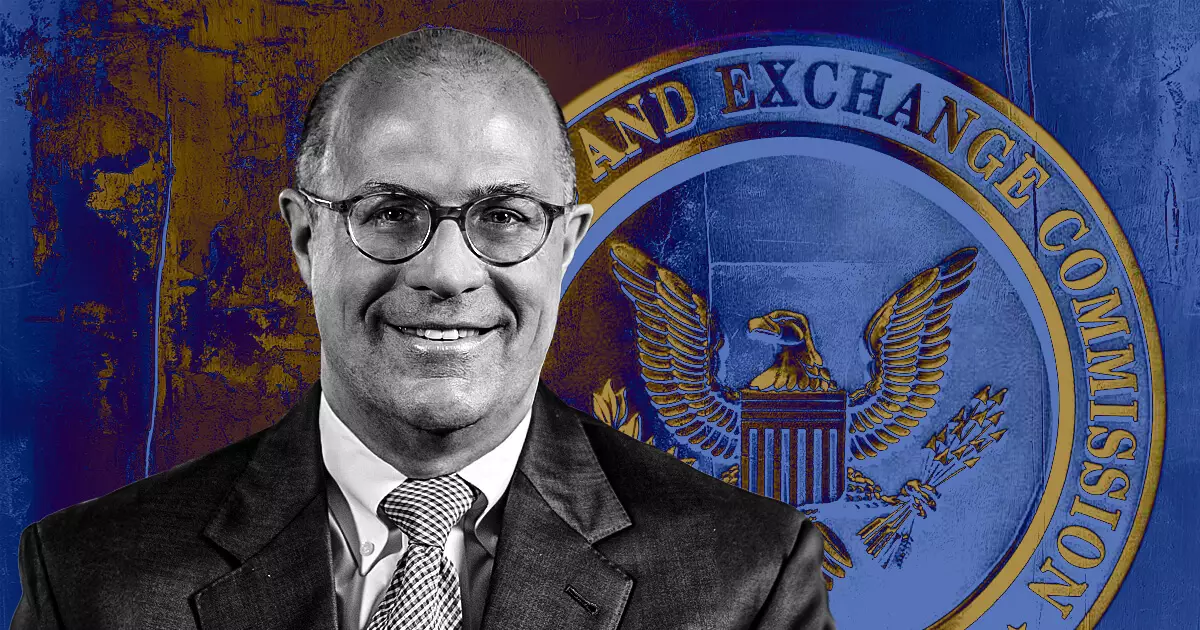

Christopher Giancarlo, a former chair of the Commodity Futures Trading Commission (CFTC), has recently found himself at the center of speculation regarding potential positions within key financial regulatory bodies in the United States. His denial of being considered as the next chair of the U.S. Securities and Exchange Commission (SEC) and the absence of interest in a role related to cryptocurrency within the U.S. Treasury Department brings several issues in regulatory leadership to the forefront. Known affectionately as “Crypto Dad,” Giancarlo has long been a proponent of cryptocurrencies and has expressed his belief that they are an indelible part of the future of finance.

While Giancarlo maintained a supportive stance towards cryptocurrency during his tenure at the CFTC, he has issues with the regulatory approaches being taken by the SEC under current chair Gary Gensler. He referred to a “mess” that he had previously cleaned up, which many speculate could relate to the SEC’s strategy of “regulation by enforcement.” This approach, which has been criticized by some officials within the SEC as catastrophic, has led to significant backlash from both the crypto industry and various stakeholders who argue that such tactics stifle innovation and create a climate of uncertainty for market participants.

Giancarlo’s choice of words signals his concern about the direction regulatory enforcement is heading, suggesting it is not only about establishing guidelines but also about ensuring that businesses can operate without undue burdens. The implications of his statements are profound: a call for regulatory clarity rather than reactive enforcement could alter the landscape of digital asset governance significantly.

In contrast to Giancarlo’s criticism, Gary Gensler has staunchly defended the SEC’s enforcement-based approach, particularly emphasizing the need to protect investors amidst a rapidly evolving digital asset landscape. In a recent conference, Gensler stated that while Bitcoin might not classify as a security, a plethora of other digital assets does, thus justifying stringent regulation. This perspective highlights an intricate balancing act; the need to ensure investor protection must be weighed against the risk of hampering innovation in the crypto sector.

His warnings about the potential for “significant investor harm” echo through the industry, stressing the importance of registering sellers and intermediaries to promote a secure marketplace. However, critics argue that this stance creates confusion and an inhospitable regulatory environment, particularly when the threshold for classifying a digital asset as a security appears to be nebulous.

As the SEC continues to initiate lawsuits against major cryptocurrency exchanges, the tension between regulatory authorities and the crypto sector remains palpable. With figures like Giancarlo advocating for a more measured approach to regulation, the growing divide suggests that the future of cryptocurrency regulation in the U.S. will depend on finding common ground between protective oversight and fostering an innovative ecosystem. It is a pivotal time that could determine the trajectory of cryptocurrency’s acceptance and integration into the broader financial industry. The conversations initiated by both Giancarlo and Gensler highlight that the discourse around cryptocurrency regulation is far from settled and will require open dialogue, re-evaluation, and a commitment to clarity moving forward.

Leave a Reply