Ethereum has recently emerged as a phoenix, revitalizing itself in a highly volatile cryptocurrency market. With thrilling gains—over 50% in just a week—many have begun to view Ethereum (ETH) not merely as an asset, but as a beacon of hope for the beleaguered altcoin community. Yet, one must temper this excitement with caution; the cryptocurrency landscape is notorious for its unpredictable nature. We stand on the precipice of yet another surge, but the question remains: Are we genuinely poised for an enduring breakout, or are we clinging to fleeting impulses driven by market euphoria?

The latest rally has taken Ethereum to around $2,740, a notable resistance point that could define the trajectory of future movements. This rapid ascension follows a phase of harsh market conditions where ETH was faced with persistent selling pressure. Nonetheless, the current price point raises alarms about potential overexuberance in a marketplace overlaying extreme leverage in derivatives—yet another layer of complexity heightening our need for vigilance as traders navigate this exhilarating yet treacherous terrain.

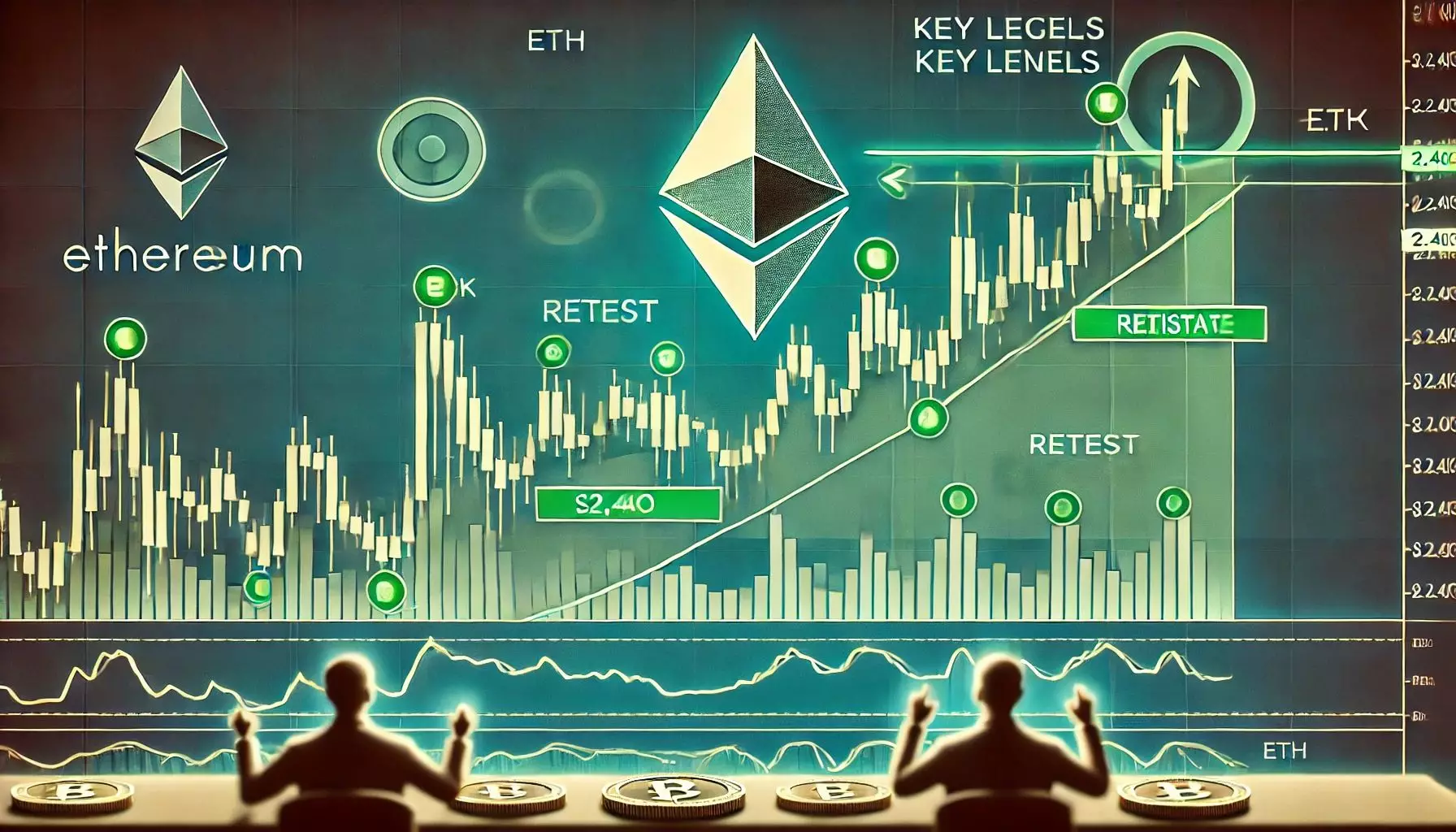

The Significance of Key Support Levels

As surging prices often mask underlying risks, the $2,400 mark has become an imperative level to observe closely. Analysts like Daan urge a retest of this critical zone, suggesting a period of consolidation might be not only beneficial but essential for building a sustainable upward trajectory. Removing excess leverage could be pivotal in allowing the market to recalibrate and establish a healthier foundation.

Moreover, the $2,400 level functions as a psychological support barrier. Finding firm footing here could alleviate investor fears and foster renewed confidence. Failing to defend this support, however, might trigger a swift descent back toward $2,200, a level that could signify even deeper woes ahead. Such a loss may not only reflect ongoing skepticism but could send ripples of anxiety across the broader cryptocurrency ecosystem, unraveling gains achieved during this recent surge.

Open Interest: A Double-Edged Sword

Open Interest in ETH derivatives has soared to alarming heights, signaling a potentially unsustainable market condition. With high leverage comes the risk of significant losses, which can manifest rapidly, spiraling into a sharp pullback. Daan’s caution against long positions in this environment is prudent; it’s a classic case of “more haste, less speed.” Traders must navigate these waters with both strategy and caution, recognizing that the current euphoria might just be a prelude to a sobering reality check.

What’s more, during times of rising Open Interest, the market tends to become increasingly vulnerable to binary movements: sharp rises or catastrophic falls. While the allure of immediate gains is compelling, history teaches that a grounded approach yields more substantial returns over time. Thus, prudent investment that prioritizes risk management over impulsive trading must reign as the guiding principle.

The Broader Context: Crypto Ecosystem Interactions

Ethereum’s robust performance does not exist in a vacuum; its success is inextricably tied to the overall health of the altcoin market. As whispers of an “altseason” circulate within cryptocurrency circles, ETH’s recent momentum can serve as a catalyst for others. Nonetheless, such interdependencies can easily spiral into an unhealthy cycle of speculation and volatility.

The influx of capital into Ethereum could empower previously sidelined altcoins, but this dynamic also introduces systemic risks. A failure to maintain upward momentum in Ethereum could trigger a fear response among investors, leading to a domino effect among other cryptocurrencies still attempting to regain footing after prolonged downturns. In this context, ETH’s performance is not merely a standalone narrative; it becomes a litmus test for the resilience of the entire market.

Future Outlook: The Path Ahead

While many analysts cling to bullish narratives, Ethereum’s immediate future is far from certain. The technical indicators point to a pending breakout above the $2,700 resistance line, but significant volume and momentum are critical for that ascent. The presence of strong, decisive buyers at key support levels will be crucial to restoring traders’ confidence and sustaining an upward trajectory toward more ambitious targets in the $3,000 to $3,100 range.

For now, we tread carefully in this dual-edged market, where both excitement and anxiety coexist. If ETH can break beyond its current struggles, a new era for Ethereum and the broader altcoin market may well lay ahead, but that journey is fraught with challenges that demand both patience and prudence from investors. As we navigate this complex landscape, vigilance and strategy will be the keys to thriving amidst the excitement and uncertainty.

Leave a Reply