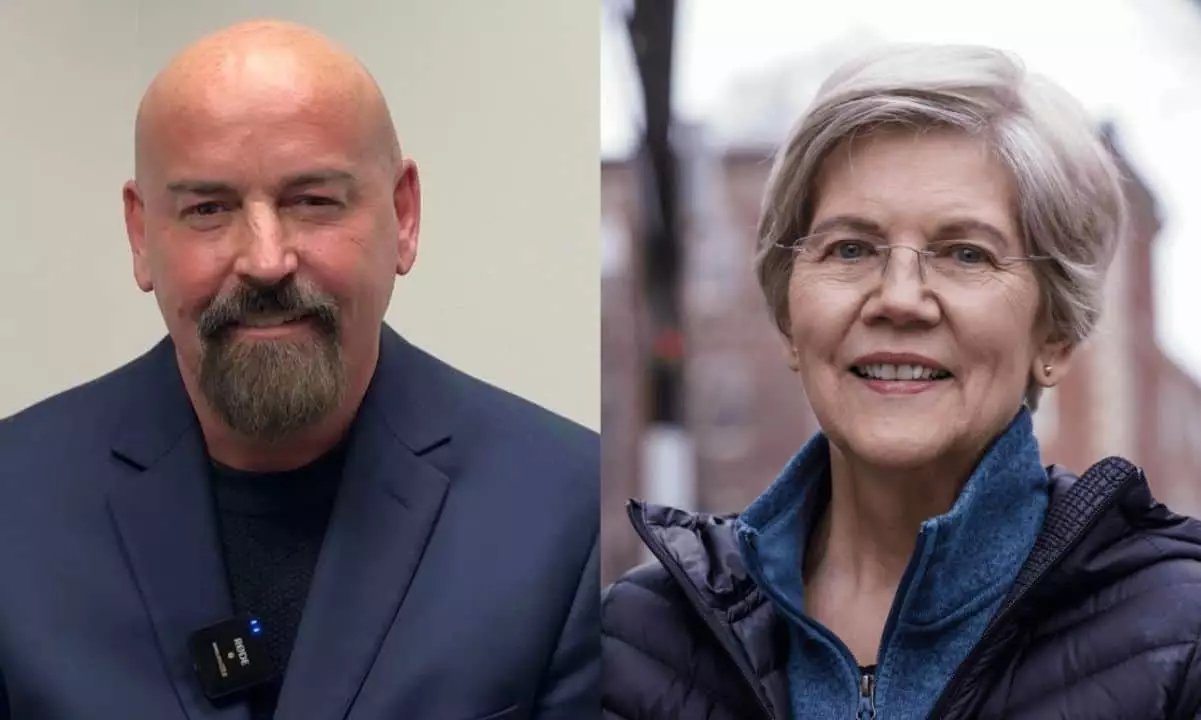

The recent debate between Massachusetts senator Elizabeth Warren and her pro-cryptocurrency opponent, John Deaton, marked a pivotal moment in the ongoing discussion surrounding digital assets and their regulation. The profound clash between the two candidates, representing divergent views on cryptocurrency, sparked critical dialogue about the implications of their positions not only for Massachusetts but also for the national financial landscape.

Competing Narratives on Cryptocurrency

Senator Warren has made a name for herself as a vocal critic of cryptocurrencies. Her stance aligns with an intent to form an “anti-crypto army,” reflecting her belief that digital assets require stringent regulations to prevent potential harms to consumers and the broader financial system. Meanwhile, Deaton, who has positioned himself as a champion for pro-crypto policies, argues that digital currencies offer vital financial solutions for marginalized communities.

The debate illuminated how these conflicting narratives pose stark consequences for the future of finance. Deaton highlighted the positive impact of cryptocurrency on individuals with limited access to traditional banking services, stating that digital assets empowered him to address the financial struggles faced by his family. Such real-life anecdotes serve to humanize the debate, showcasing how the abstract discussions about cryptocurrencies translate into tangible benefits for everyday people.

The exchange quickly intensified when Warren accused Deaton of potentially prioritizing crypto industry interests over the voters who elected him. The implication was clear: if Deaton entered Congress, he might be beholden to the cryptocurrency sector, which could compromise his ability to advocate for the public at large. Deaton, however, countered this narrative by pointing out Warren’s own financial affiliations and support from corporate political action committees, which he asserted undermined her criticisms.

This back-and-forth resulted in a compelling exploration of political integrity at a time when voter skepticism about the influence of money in political campaigns is prevalent. The debate not only exposed the varying degrees of financial dependency that each candidate faces but also raised legitimate questions about the motivations behind their respective positions on blockchain technology and crypto.

Deaton’s criticism of Warren for focusing on cryptocurrencies while neglecting pressing issues like inflation strikes at the heart of what many voters care about. His remarks, punctuated by a biting quip wishing that Warren attacked inflation with the same vigor she showed toward crypto, resonated with constituents feeling the weight of economic pressures in their daily lives. This aspect of the debate highlighted the necessity for politicians to address the immediate concerns of their electorate rather than become engrossed in niche issues.

In contrast, Warren pushed back by reiterating her stance that cryptocurrencies pose significant threats like facilitating illegal activities. By framing her stance as a quest for consumer protection, she positioned the debate not merely as a battle over cryptocurrency but as one between the security and interests of everyday Americans versus potential risks associated with financial innovation.

The Path Forward for Crypto Regulation

Ultimately, this debate underscores a crucial moment for both policymakers and stakeholders in the cryptocurrency space. Deaton urged for legislation that would empower individuals, arguing against existing proposals that would restrict Bitcoin self-custody while allowing large financial institutions to dominate the market. These discussions raise critical questions about regulatory frameworks that prioritize consumer choice versus maintaining systemic safety and security in financial transactions.

Warren’s insistence on imposing the same regulations on crypto as are applied to traditional banking gestures towards a future where cryptocurrencies might need to evolve and integrate into established financial protocols. However, it also invites skepticism from crypto advocates about potential overreach and the dilution of the innovative spirit underpinning the blockchain movement.

The fervent exchange between Warren and Deaton exemplified not just a contest for political office but a broader philosophical battle over the direction of finance in America. As digital assets continue to grow and evolve, finding a balance between innovation and regulation will be vital, demanding that both sides engage in thoughtful dialogue rather than simply resorting to accusations. The outcomes of such debates will indubitably shape the future landscape of both policy and financial technology in the years to come.

Leave a Reply