The cryptocurrency market, once a beacon of hope and innovation, has recently found itself enveloped in uncertainty. Ethereum, the second-largest digital currency, is currently grappling with a significant resistance level, trading around $1,610 amidst mounting fears fueled by global trade tensions. While many hope for a resurgence, this situation parallels the volatility we’ve come to associate with the crypto market. The broader implications of the trade spat between the United States and China cannot be overlooked. The U.S. administration’s recent tariff pauses, although intended to alleviate immediate tensions, have sparked concerns about a protracted economic conflict that could have far-reaching effects on financial markets. It raises the question: How can Ethereum possibly gain traction in this convoluted landscape?

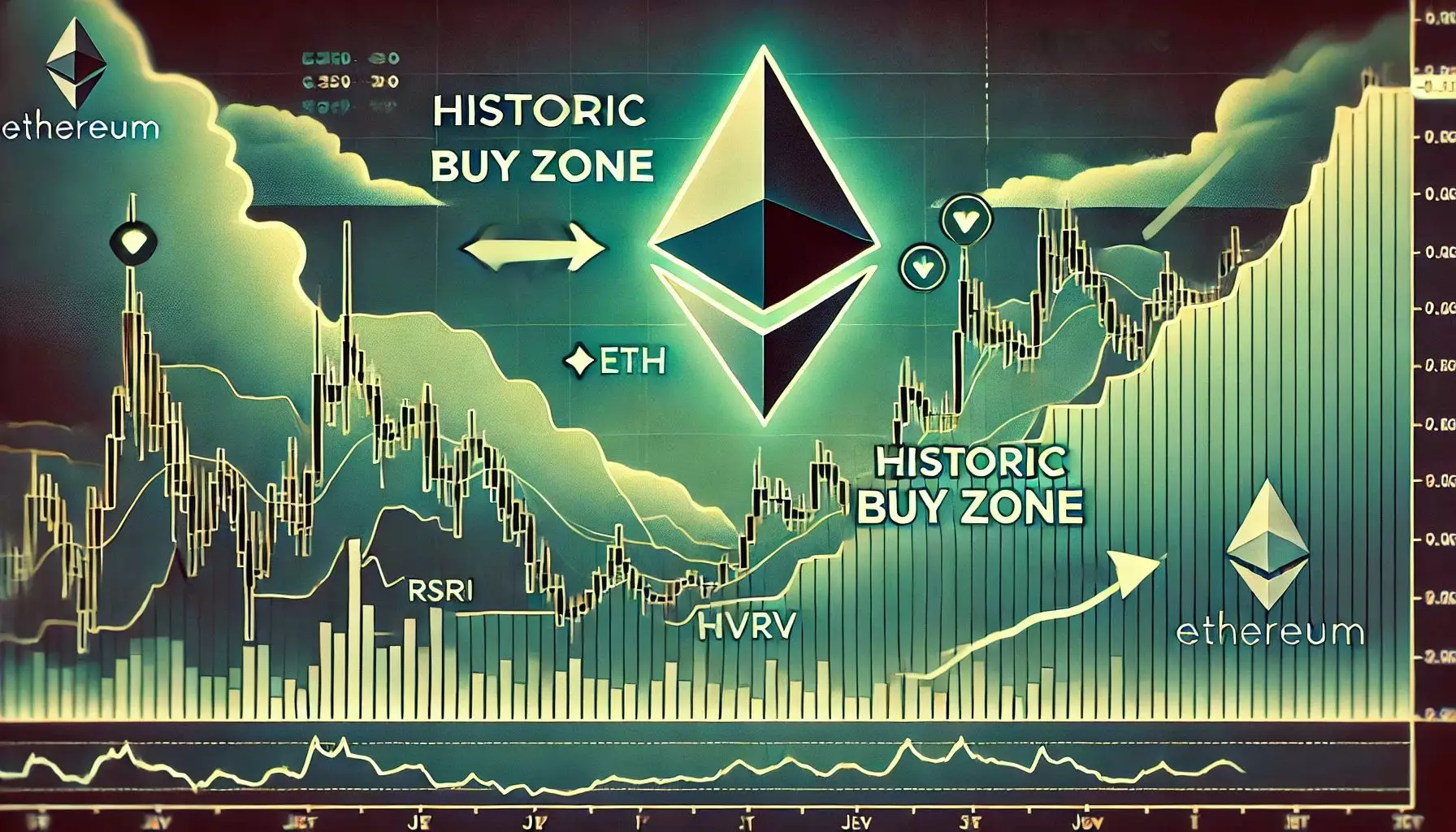

For instance, crypto analyst Ali Martinez highlights a historical trend that reveals buying opportunities often align with dips below the lower MVRV (Market Value to Realized Value) Price Band. Today, Ethereum finds itself trading in that zone, which could indicate potential undervaluation. But should investors view this as a golden opportunity or merely a mirage in these uncertain times? With bulls struggling to assert control after a 21% drop from the critical $2,000 mark, one must wonder whether this environment will allow for any real recovery.

Market Sentiments: Fear Looms Over Enthusiasm

There’s a palpable tension invading the crypto community; a mix of hope and despair. Investors are facing a harsh reality as macroeconomic uncertainties escalate. Wavering market sentiment has compelled many to retreat from riskier assets, creating a substantial decline in trading volume for cryptocurrencies like Ethereum. Why does this matter? Because it signifies a loss of confidence, and with it, the vitality that fuels price movements. One cannot ignore the psychological barriers at play. As Ethereum oscillates between $1,550 and $1,630, it embodies a broader narrative of hesitation—a reluctance to take a risk when there are more pressing matters at hand, such as looming recession fears due to trade wars.

The dynamic is clear: bullish momentum hinges on overcoming critical resistance levels—specifically, reclaiming the $1,700 threshold. Not only is this a psychological barrier—even more a test of the community’s sentiment—but it also represents a shift from a history of failures into potential successes. Yet each day that Ethereum fails to break through this ceiling only serves to deepen the skepticism that surrounds it. Investors are left questioning if a breakout is on the horizon or if they will face an even steeper decline.

Glimmers of Hope Amidst Pessimism

Amidst this chaotic environment, there are pockets of optimism, albeit cautiously expressed. Some analysts see Ethereum as nearing a crucial turning point. When trading falls below the historical lower MVRV price band—now the case—there could be a significant uptick once the dust settles. Martinez emphasizes that this particular stance has often preceded robust rebounds, particularly amidst grim market conditions. While the temptation to jump in as a long-term investor is strong, caution must also prevail. A prudent approach would advise waiting for market conditions to stabilize—essential before any aggressive accumulation can take place.

Even in this drawdown, for every seller retreating into cash, there may be a savvy investor eyeing the discounted price as an opportunity. History might suggest these reflect points ripe for acquisition, assuming that bears don’t push the market too far down. However, should the price fail to hold above $1,550, fear could become rampant, triggering sell-offs and reinforcing the narrative of cryptocurrency as a volatile and risky investment.

Waiting for Catalysts: A Game of Patience

As traders continue to ride the emotional rollercoaster of crypto investment, anticipating a breakout or a breakdown becomes a waiting game. Ethereum’s oscillation mirrors broader market trends—exhibiting price compression that often foreshadows significant movements. But this time, the stakes feel higher. With macroeconomic stresses, anxieties concerning trade, and evolving investor sentiment weaving through the fabric of the crypto landscape, months of incremental gains seem distant.

In this high-stakes arena, participation volatility is soaring, leaving investors to prepare for fluctuating outcomes. Any signs of recovery will be contingent upon overcoming pressing resistance levels while navigating the unpredictability that characterizes the space. Until Ethereum can break free from its current confines, we remain in a dangerous limbo where patience weighs heavier than ever. Therefore, it’s imperative for investors to weigh the risks against potential gains before making hasty decisions in this turbulent arena.

Leave a Reply