Bitcoin, the leading cryptocurrency, has faced its fair share of fluctuations, but recent events reflect a fascinating intersection between political leadership and market dynamics. With the cryptocurrency hitting an unprecedented peak of $109,558 coinciding with the inauguration of President Donald Trump, speculation around a Strategic Bitcoin Reserve (SBR) has captured the attention of traders and analysts alike. This article delves into how political developments can influence Bitcoin’s valuation and what it indicates for the future of this digital asset.

The Surging Speculation Around SBR

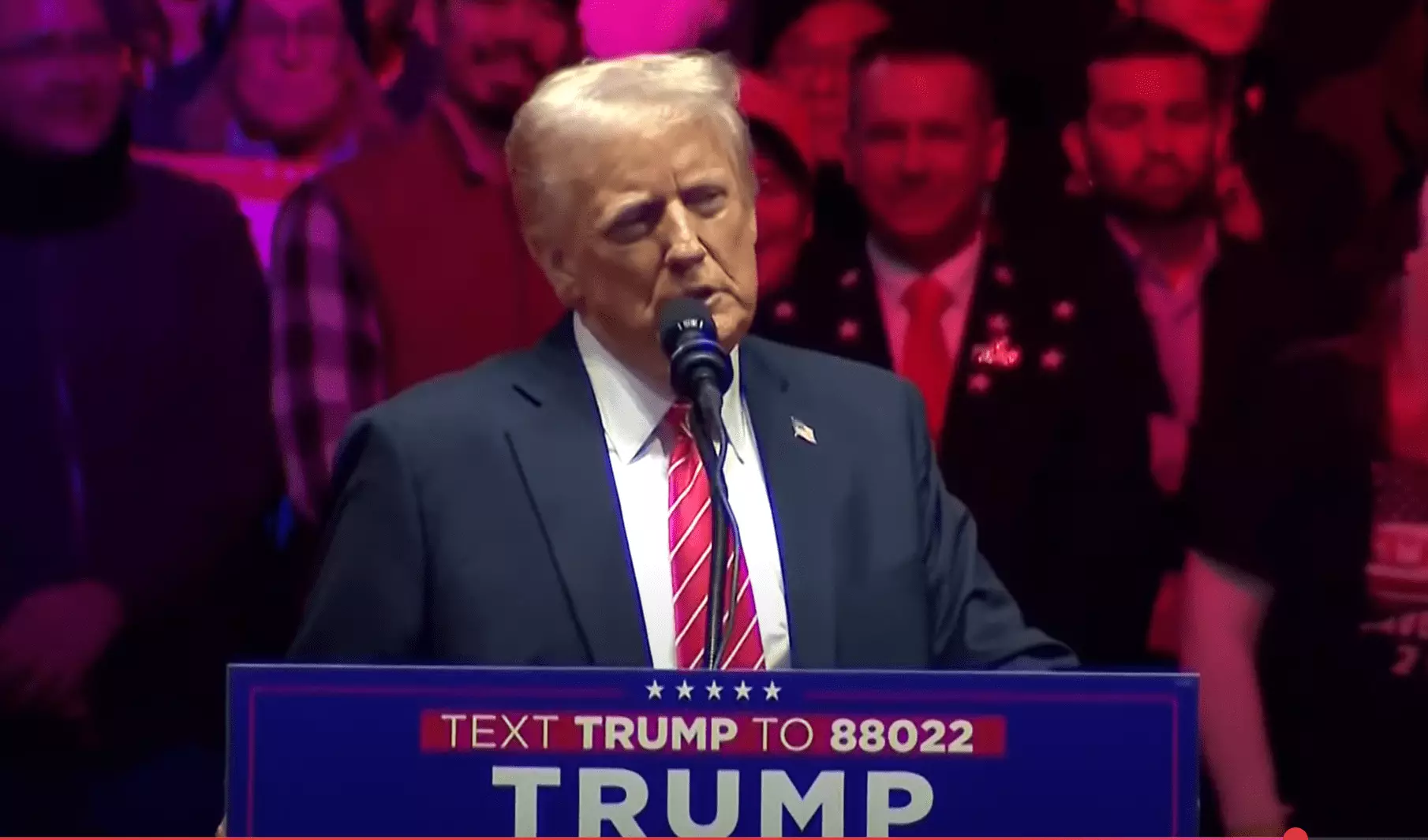

The day of President Trump’s inauguration marked a significant upswing in Bitcoin’s price, which market observers partially attribute to rumors surrounding the potential establishment of a Strategic Bitcoin Reserve. Such a reserve would involve the U.S. government implementing a formal framework for holding Bitcoin as part of its asset management strategy. The speculation surrounding this initiative wasn’t entirely new; it had gained momentum over the past few months.

The crypto-based prediction platform, Polymarket, indicated a noticeable rise in the odds—up to 59%—suggesting that an SBR could come into existence within Trump’s first one hundred days in office. This scenario, while speculative, highlighted how political narratives and executive actions could substantially sway investor sentiments and market valuations. Historically, Trump’s administration had dabbled in discussions about channeling seized Bitcoin into governmental reserves, echoing the possibilities presented by current market conditions.

The implication of a potential SBR inevitably brought influential figures in the cryptocurrency space to the forefront. Senators John Barrasso and Cynthia Lummis reportedly engaged in dialogue with Trump just before his inauguration, further reinforcing the credibility of the rumors. Lummis, a vocal proponent of Bitcoin, expressed on social media her determination to push forward legislation that would facilitate the creation of such a reserve, showcasing the broader motivation among lawmakers to embrace cryptocurrency within the legal framework.

Moreover, the presence of significant industry players at meetings with Trump’s administration highlights how interconnected the realms of politics and cryptocurrency have become. MicroStrategy’s Michael Saylor, who has heavily invested in Bitcoin, also joined these conversations, emphasizing a collective push for favorable policies that could benefit the digital asset ecosystem.

As news emerged about these discussions, the market responded with volatility typical of cryptocurrency trading environments. Bitcoin’s ascent to new heights serves as a reminder of the cryptocurrency’s sensitivity to external news, particularly political developments. Analysts like Charles Edwards from Capriole Investments observed how rapid price movements could signal underlying momentum shifts, suggesting that aggressive retraction followed by a strong rebound might indicate a new trend setting in.

The speculative nature of Bitcoin trading means that every mention of a supportive regulatory framework or governmental interest can trigger significant price movements. Analysts note that the market often reacts not just to confirmed news but also to the possibilities that remain under discussion in the political arena.

The prospect of an SBR or similar initiatives could significantly influence how cryptocurrencies are perceived, both domestically and internationally. Should the U.S. government actively engage with Bitcoin as part of its asset management, it could inspire other nations to explore similar frameworks, potentially leading to broader acceptance and integration of cryptocurrency into traditional financial systems.

Moreover, as the conversation surrounding regulations and asset reserves grows, the role of advocates in both the political realm and the cryptocurrency community becomes increasingly vital. Figures like David Bailey express optimism about such initiatives, aligning with a vision of America as a “Bitcoin and Crypto Superpower.” This collective ambition could shape the future of cryptocurrency legislation, pushing for comprehensive and supportive regulatory environments.

As Bitcoin continues to dance to the rhythm of political developments, the recent surge serves as a salient reminder of the intricate relationship between governance and digital assets. The narrative surrounding a Strategic Bitcoin Reserve reflects not just market speculation but also a genuine interest from various stakeholders in making cryptocurrencies a fixture of the American financial landscape. While volatility remains a hallmark of Bitcoin trading, the potential for significant regulatory support could offer newfound stability and growth in the cryptocurrency market.

In this evolving landscape, investors must remain vigilant and adaptable, recognizing that both economic trends and political shifts will shape the trajectory of cryptocurrencies like Bitcoin in the times to come.

Leave a Reply