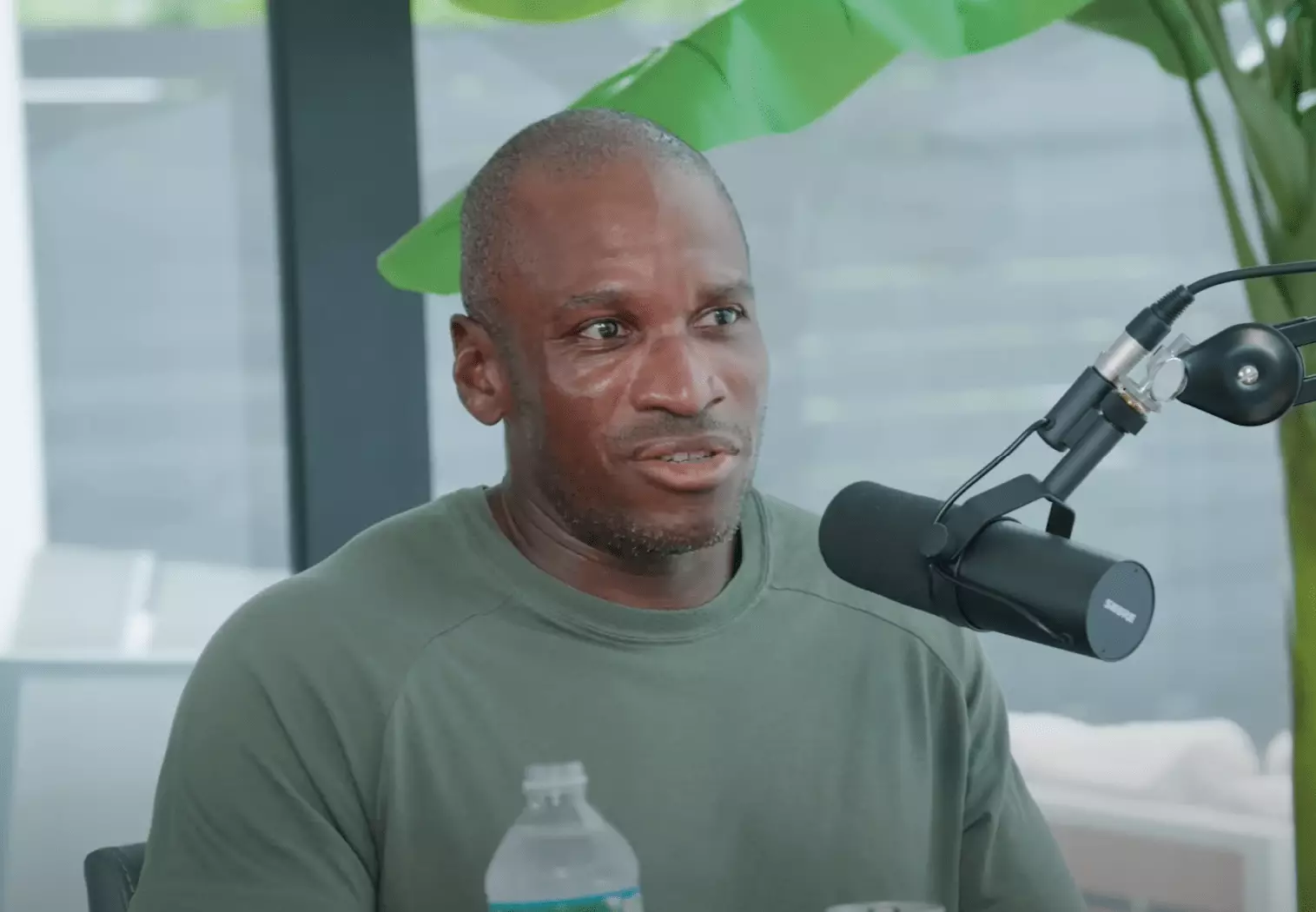

In a world where economic paradigms seem to shift daily, Arthur Hayes, the co-founder and former CEO of the cryptocurrency exchange BitMEX, has laid out an audacious vision for the future of Bitcoin. In his latest essay titled “Black or White?”, Hayes posits that Bitcoin could reach the staggering price of $1 million, driven by what he sees as transformative economic policies likely under the second term of Donald Trump. His analysis not only taps into the irrepressible rise of cryptocurrencies but also reflects on the deeper economic currents reshaping global finance.

Hayes draws a compelling parallel between the economic strategies of the United States and China, coining the term “American Capitalism with Chinese Characteristics.” This concept captures a troubling evolution in the U.S. economic landscape that diverges from traditional capitalist ideals. According to Hayes, the primary objective of U.S. economic policy has shifted from strictly capitalist goals to retaining governmental power at all costs. His assertion rests on the belief that since the establishment of the Federal Reserve in 1913, the loss inherent in capitalism—whereby the wealthy could suffer from poor decisions—has been curtailed.

This historical analysis prompts a crucial query: What does this mean for the average citizen? Hayes provides a granular examination of the transition from “trickle-down economics” to stimulus measures that prioritize direct financial relief, particularly those seen during the COVID-19 pandemic. He reveals that while quantitative easing (QE) benefitted the elite disproportionately, direct financial assistance systems proved more effective in stimulating genuine economic progress.

As Hayes dives deeper into the economic implications of direct stimulus, he highlights a pivotal shift in how funds were allocated. During the tenures of Presidents Trump and Biden, the Treasury’s actions led to a significant decrease in the U.S. debt-to-nominal GDP ratio—a phenomenon that he attributes to the increased purchasing power of the general populace. This theory not only challenges conventional financial wisdom but also provides a compelling rationale for why policies that resonate with the masses can trigger economic rebirth.

Hayes envisions a reinstatement of Trump, accompanied by policies promoting the repatriation of key industries, financed through expansive government expenditure and a surge in bank credit. He expresses particular confidence in Scott Bassett as a potential Treasury Secretary, indicating that Bassett’s vision for tax credits and subsidies designed to incentivize domestic production could fundamentally reshape the economic landscape.

While Hayes presents a utopian vision for expansionary fiscal policies, he doesn’t shy away from highlighting potential inflationary hazards that could follow. The ramifications of such proactive economic strategies could lead to significant currency debasement, severely impacting those who depend on long-term bonds or savings deposits for financial security. To mitigate this risk, Hayes firmly advocates for investment in assets such as gold and Bitcoin, highlighting their potential as safekeeping measures amid economic turmoil.

However, this raises essential concerns regarding the sustainability of investing in such risk-sensitive assets. While he presents these investments as hedges against fiscal ineptitude, the question remains whether the general populace can transform perception into tangible gains.

Hayes offers an intricate dissection of the mechanics surrounding monetary policy. He emphasizes that “QE for the poor”—essentially providing direct financial assistance—could significantly invigorate economic growth by prompting consumer spending. In this context, he notes how demand could revitalize industries and lead to job creation, thus outlining a blueprint for robust economic activity.

Furthermore, Hayes alludes to potential regulatory shifts, specifically regarding the Supplemental Leverage Ratio (SLR) exemptions that could open doors for limitless purchasing of government debt by banks. This prospect of “infinite QE” poses the question: How will asset markets react to such monumental changes? Will Bitcoin and other cryptos indeed rise, paralleling the arc of aggressive fiscal policies?

To conclude, Hayes makes a bold claim positing that Bitcoin is uniquely positioned to thrive in a landscape marked by aggressive fiscal expansion. The predictive mathematics he outlines paint a vivid picture of Bitcoin as the primary beneficiary in an era where traditional fiat currencies face the specter of devaluation. As the supply of Bitcoin dwindles, an influx of capital—potentially the most substantial in history—could see the cryptocurrency climb to unprecedented heights.

His closing remarks serve as both a warning and a rallying cry for investors to brace for the impending shifts in the economic landscape. “Get long, and stay long,” he urges, while also inviting skeptics to analyze historical trends in Chinese economic history to comprehend the potential echo of these macroeconomic shifts in the U.S.

In sum, Hayes presents a roadmap that intertwines ambitious fiscal forecasting with a plea for strategic asset allocation, urging a shift that may redefine financial stability in a rapidly changing world. Whether Bitcoin soars to the proposed $1 million or not, the underlying transformations in monetary policy and economic management will certainly have lasting impacts on the global financial ecosystem.

Leave a Reply