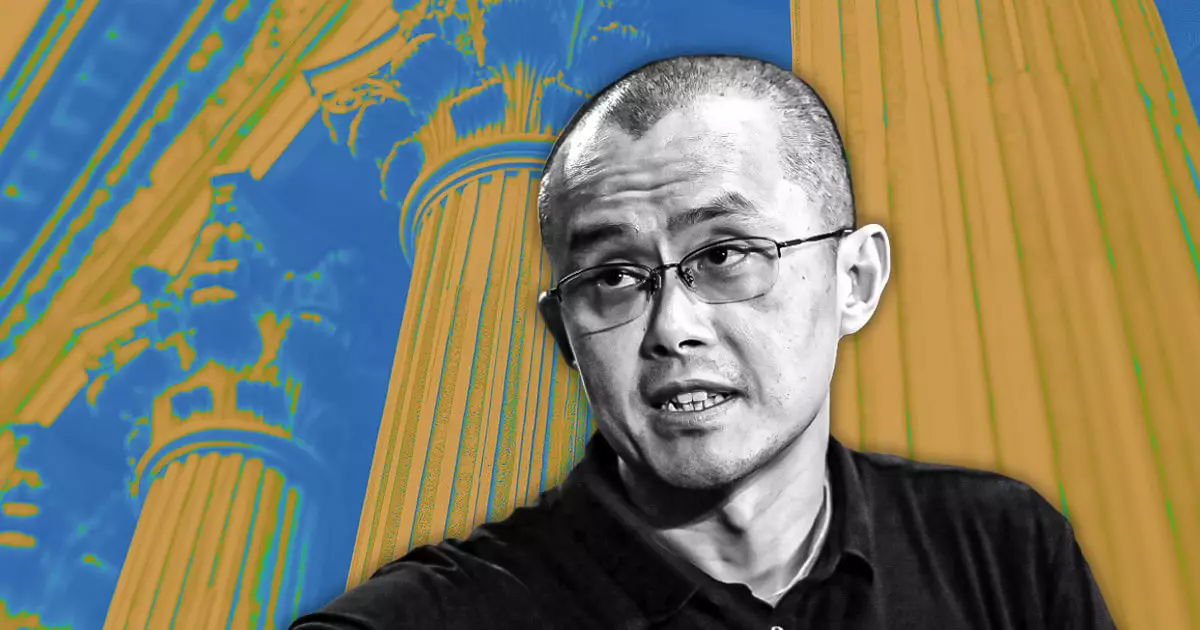

In a climate rife with speculation and rampant misinformation, Changpeng Zhao, widely known as ‘CZ’, the founder and former CEO of Binance, has taken a bold stance against recent allegations regarding the potential sale of the crypto exchange. On February 17, in a declarative social media post, he clarified that while there were no current plans to sell the company, Binance might explore the option of selling minority stakes to outside investors down the line. This assurance came in response to swirling rumors fueled by a perceived competitor in Asia that attempted to stir doubt amongst Binance users regarding the exchange’s stability and longevity.

Zhao’s use of the term “misinformation” highlights his frustration with the fuel that speculation has added to an already volatile industry. He attributed these rumors not only to competitive jealousy but also emphasized the continued health of Binance. The assertion that Binance’s financial strategies would remain private even whilst permitting external investment suggestions a balance between openness and strategic confidentiality. Financial dynamism in the crypto market has beckoned outside interest, as illustrated by Zhao’s comments that top investors have historically sought opportunities within Binance. He hinted that there could be a future where minor investments, likely constituting single-digit ownership stakes, might be welcomed.

The co-founder of Binance, Yi He, echoed Zhao’s sentiments by asserting that the exchange remains in a position of strength regarding investor interest whilst currently opting to maintain majority ownership with no current intentions for dilution. The timing of this conversation is critical, especially as users flagged significant changes in the exchange’s crypto holdings. This often leads to confusion among users as they navigate the treacherous waters of crypto investments and the implications of perceived asset liquidation, especially concerning prominent assets such as Bitcoin. Nonetheless, Binance clarified that these shifts resulted from a treasury management approach rather than indicative of a downward spiral in financial health.

The emergence of these rumors came against a backdrop of increasing regulatory scrutiny within the crypto market, intensifying speculation about Binance’s future strategies. Some industry observers posit that these developments might affect Binance’s robust position as the largest crypto exchange by trading volume in spite of facing rising competition from other centralized exchanges (CEXs). The potential for minority stake sales could serve as both a buffering strategy against regulatory pressures and a means of reinforcing operational autonomy—a delicate balance that illustrates the nuanced interplay between public trust, financial strategy, and market positioning.

The notion of allowing minority investments could symbolize a pivotal shift in Binance’s historically private ownership model. In an environment characterized by rapid change and innovation, the participation of institutional players could not only further solidify the influence of Binance on the global stage but may also attract additional scrutiny. As the crypto world continues to evolve, Binance’s navigational choices regarding investor relationships will prove critical in defining the exchange’s pathway forward amidst uncertainty. As we look to the future, the crypto community will undoubtedly remain vigilant, eagerly yearning for clarity in the opportunities and challenges that lie ahead for one of the market’s most influential entities.

Leave a Reply