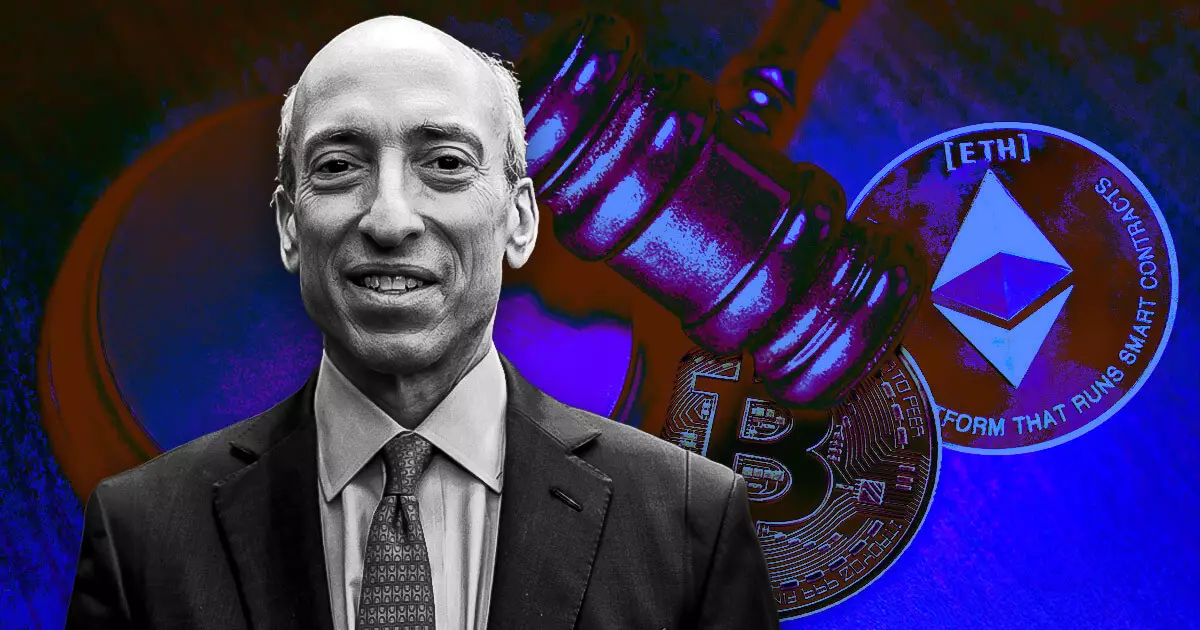

The dynamic landscape of cryptocurrency regulation has reached yet another critical juncture, particularly with the impending rejection of two spot Solana (SOL) exchange-traded fund (ETF) applications by the US Securities and Exchange Commission (SEC). Renowned Bloomberg ETF senior analyst Eric Balchunas has revealed that this decision is largely influenced by the current SEC Chair, Gary Gensler, who is anticipated to leave his position in early 2025. The implications of these rejections are profound, reflecting not just on Solana but on the broader cryptocurrency market.

The SEC’s hesitation to approve these ETFs stems from its ongoing litigation stance, where multiple cryptocurrencies, including Solana, are deemed as securities in several lawsuits. This classification poses a significant challenge for the SEC, as allowing Solana-related ETFs while asserting that the cryptocurrency is a security would compromise the regulatory body’s credibility. Fellow Bloomberg analyst James Seyffart argues that, given the prevailing atmosphere saturated with legal uncertainties, these ETF applications are virtually “dead in the water.”

The Future of Crypto ETFs Under New Leadership

With Gensler’s term concluding on January 20, 2025, many are looking towards incoming SEC chair Paul Atkins for a change in direction regarding cryptocurrency regulations. Balchunas believes that once Atkins takes the helm, the potential for Solana ETF applications to be refiled becomes possible. This transition is not merely a change of personnel but a potential shift towards a more lenient stance on the approval of crypto-related financial products.

If the new administration acknowledges the growing demand for cryptocurrency ETFs and the legitimacy of Solana as an investment vehicle, 2025 could evolve into a significant year for crypto ETF approvals. However, until a clear regulatory framework is established, the market will remain in a state of ambiguity, which can stymie innovation and investment opportunities.

The Broader Implications for the Crypto Market

This move by the SEC to reject Solana ETF applications highlights a larger narrative concerning regulatory approaches to digital assets in the US. Industry players are left grappling with inconsistent regulations that create uncertainties not just for investors but also for companies planning to enter the crypto space. Former VanEck director Gabor Gurbacs noted that Gensler’s potential exit signals hope for renewed possibilities in the cryptocurrency market, suggesting that a more open regulatory framework could encourage institutional investment.

Moreover, the recent SEC brief regarding the Binance Exchange further complicates matters. The issuance of an extensive legal document opposing the dismissal of a lawsuit concerning Binance’s offer of several tokens as investment contracts raises questions about the regulator’s strategic focus. This, coupled with the Solana ETF setbacks, frames the US regulatory environment as one fraught with challenges, hindering progress towards clarity and operational freedom for cryptocurrency entities.

The SEC’s rejection of the Solana ETFs underscores a critical moment in the ongoing evolution of cryptocurrency regulation in the United States. As legal ambiguities surrounding cryptocurrencies persist, the future of crypto ETFs may hinge upon forthcoming leadership transitions within the SEC. The industry awaits clarification and direction that could ultimately pave the way for a more robust trading environment for digital assets, ensuring that innovation does not take a backseat to regulatory caution. In a rapidly changing market, the forthcoming shifts could generate ripples that extend well beyond Solana’s prospects, impacting crypto as a whole.

Leave a Reply